Pradhan Mantri Suraksha Bima Yojana (PMSBY) is one scheme amongst the three schemes that were launched in the 2015 budget. PMSBY? is an insurance scheme against accidents and offers one year cover for disability. The bima or insurance has an annual renewal subscription policy. The insurance cover starts from 1 June to 31 May of the succeeding year. The option to join and pay with the help of auto-debit is given by May 31. Anyone who wants to continue beyond the first year must extend the consent before 31 May.

Today Update

Pradhan Mantri Suraksha Bima Yojana is the best insurance scheme

Everyone has to take it. At least those who are there in the traveling field have to take compulsory. Who knows what will happen now.

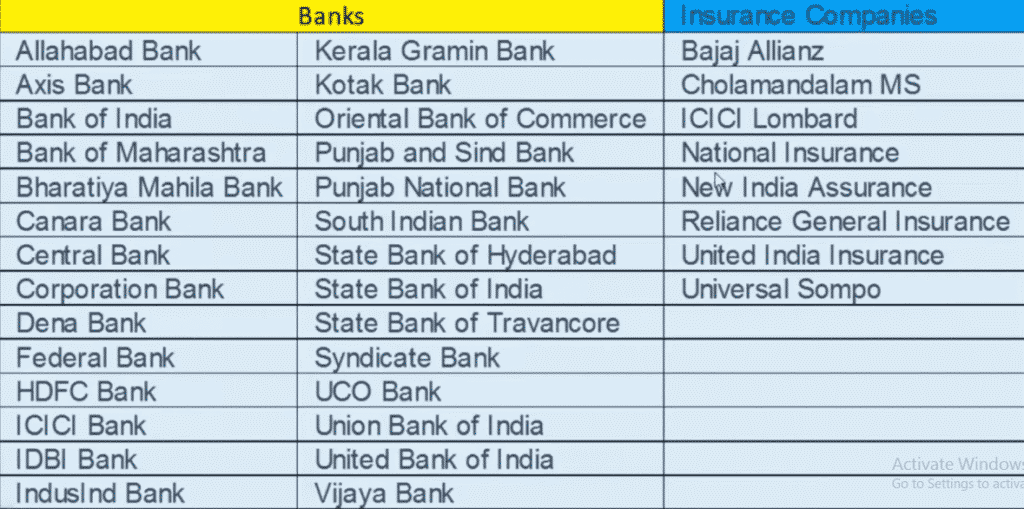

Below we have given a list of Banks and Insurance Companys who are Participating in the PMSBY Scheme.

[adinserter block=”4″]

Details of the PMSBY Scheme?

Under the scheme, the risk coverage offered is around 2 lakhs for death and1 lakh for disability (permanent). It will add to the earlier existed insurance if the subscriber has any. Do not confuse it with medi-claim as there is no provision for amount reimbursement regarding hospital expenses for any accidents that leads to either disability or death.

The eligibility of the scheme is that an individual must be between the age gap of 18-70 having a proper bank account and with a nominee name. The premium of the insurance scheme will be directly debited to the account of the subscriber every year before 1st June of annual coverage.

Also Read: Bhoomi Karnataka Land Records Online

PMSBY Scheme Overview

| Article Name | Pradhan Mantri Suraksha Bima Yojana |

| Launched by | Central Government BJP Party |

| Launched on | 2015 |

| Premium Amount | 12 Rs Per Year |

| Insurance Cover Starts From | 1 June to 31 May |

| Risk Coverage | 1 Lakhs to 2 Lakhs |

| Age Limit | 18-70 Years |

| Mandatory to Apply | AAdhar Card & Bank Account |

CCLA Telangana Webland Records

PMSBY Banks and Insurances Companys Lists

PMSBY Required Documents to Apply

- AAdhar Card

- Bank Account

- To apply for PMSBY Schemes Both are Mandatory

- Pan Card

- Date of Birth Certificate

Pradhan Mantri Suraksha Bima Yojana Forms to Apply

[adinserter block=”4″]

| PMSBY Form English | PMSBY Form Bangla |

| PMSBY Form Gujarati | PMSBY Form Kannada |

| PMSBY Form Hindi | PMSBY Form Telugu |

| PMSBY Form Marathi | PMSBY Form Tamil |

| PMSBY Form Odia |

Pradhan Mantri Suraksha Bima Yojana Forms to Claim

| PMSBY Form English | PMSBY Form Punjabi |

| PMSBY Form Gujarati | PMSBY Form Telugu |

| PMSBY Form Hindi | PMSBY Form Tamil |

| PMSBY Form Marathi | PMSBY Form Odia |

Also Read: YSR Cheyutha Scheme Latest News

PMSBY Frequently Asked Questions

What is the term for risk coverage?

Any individual has to opt for the scheme every year and can choose for a long-term option and in that case, the account will be auto-debited annually.

Who is going to implement the scheme?

The PMSBY scheme is implemented by Public Sector General Insurance Companies and people who are interested to join the scheme and get tie-up with the relevant banks for the purpose.

What is Government Contribution?

There are several ministries who can contribute to different categories of their beneficiaries. All the funds come from Public Welfare Fund. Moreover, the common expenditure is always incurred by the government.

What is the Premium amount and how can you pay?

The annual premium amount is Rs 12 and is deducted from the bank of the subscribers on a yearly basis before 1st June. Only if the debit takes place after 1 June, the cover will start from the date of auto-debit of the premium.

Where can you buy the insurance scheme PMSBY?

When the administration of the scheme is looked after by the Public sector general insurance companies in tie-up with the banks, they are responsible for the selling of the scheme. Moreover, they can appoint any general insurance company to sell the scheme to the participants. If you want to enroll, get it from the https://jansuraksha.gov.in/Forms-PMSBY.aspxand submit the form to your bank.

Presently some banks have started the process of enrolling scheme subscribers via SMS service.

What to do when you have to claim?

The claim is covered with documentary proof in case of deaths and any other accidents. Moreover, the accident must have a police complaint. Only when accidents like falling from a tree or insect bite, the hospital must offer support for the cause.