Pradhan Mantri Vaya Vandana Yojana (PMVVY) is a scheme for the senior citizens of the nation. The scheme is entirely taken care of by LIC (Life Insurance Corporation). With this scheme, an individual will receive an 8% assured return per annum. On the other hand, subscribers can easily opt for month-wise, quarter-wise, half-yearly/yearly pension payment.

The scheme officially came into the picture on 21 July 2017 by Arun Jaitley. It is a great step for senior citizens at a time when the interest rate was falling dubiously.

Pradhan Mantri Vaya Vandana Yojana Reasons for Implementation

There are several reasons why the scheme is launched in India. Let us check them to know more about the scheme and its benefits. In India, many older couples and family members do not get government pension as they are not government employees. So, to combat the financial issue of these families, Arun Jaitley introduced this scheme. The scheme offers several benefits for which it is highly recommended for the people of India.

- Pension Payments: The PMVVY scheme offers a stable pension for ten years to the senior population within a chosen frame of time.

- Death Benefit: If at any event the holder of the policy dies, then the price of the PMVVY scheme will entirely be forwarded to the nominee.

- Maturity Benefit: The scheme provides a benefit of Maturity as the policyholders survive the entire scheme duration. The benefit is the pensioner is returned the entire purchase price along with the final pension installment.

- Value of Surrender: The PMVVY scheme offers the policyholders to withdraw their money under the term. These are allowed only during emergency circumstances wherein patients require medical attention or anyone in the house is terminally ill. The surrender value here is 98% against the price of the policy.

LIC Pradhan Mantri Vaya Vandana Yojana Overview

| Name of the scheme | Pradhan Mantri Vaya Vandana Yojana |

| Name of the organization | Government of India |

| Launched on | 21 July 2017 |

| Implementation in | India |

| Announced by | Indian Govt. |

| Aid to | Senior Citizens |

| Aid per month (rs) | 1000, 3000, 6000, 12000 |

| Official Website | http://www.licindia.in |

Salient Features and Details

The PMVVY scheme has certain features and requirements. If you can comply with these requirements, then you can avail the benefits of the pension scheme.

- The minimum age of the policyholder must be 60.

- There no maximum entry age

- The term policy is for 10 years

- The policyholders will be offered a pension for 10 years

- Users can select the payment policy and time period (monthly-quarterly-half yearly-annually)

- The minimum pension for the policyholders is: Rs 1000 per month, Rs 3000 quarterly, Rs 6000 half-yearly, Rs 12000 annually.

- The maximum amount for pension received by the Rs 10,000 per month, Rs 30,000, Rs 60,000 half-yearly, and 1.2 Lacs annually.

- The scheme does not come under the Goods and Service Tax (GST)

Eligibility Criteria for PMVVY

- The minimum age of the policyholder must be 60.

- There no maximum entry age

- The term policy is for 10 years

How to Apply for Pradhan Mantri Vaya Vandana Yojana

For senior citizens who want to apply for the PMVVY scheme can do everything online. They can fill an application form in the Life Insurance Corporation website.

[adinserter block=”4″]

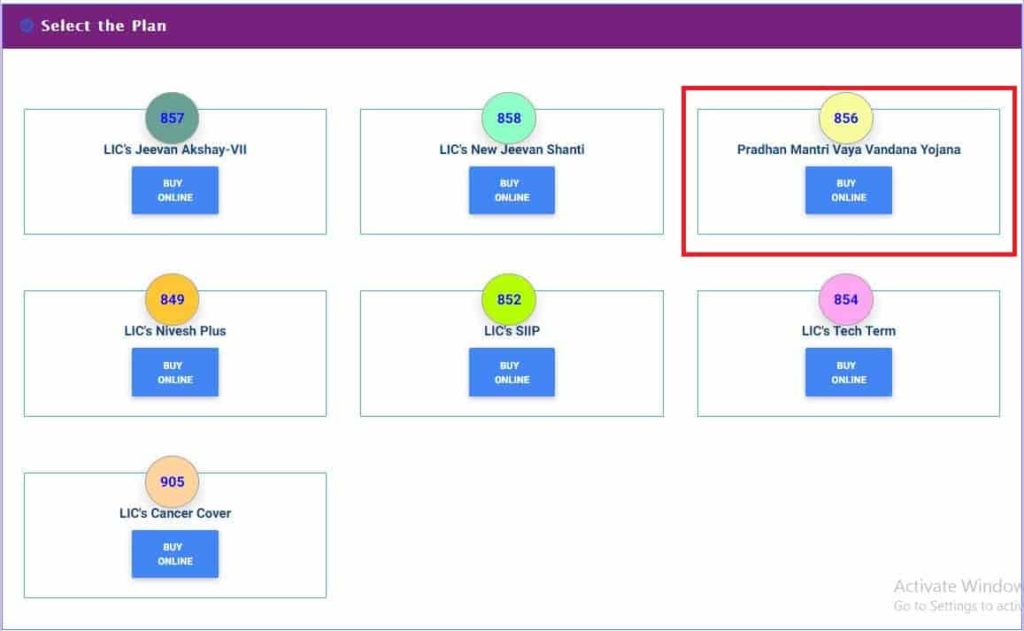

- First, open the LIC website https://onlinesales.licindia.in/eSales/liconline

- Click on the link which says Pradhan Mantri Vaya Vandana Yojana

- On the following page, you will see an option called ‘ Buy Online’

- The application will open and you are required to complete the form by filling in the right credentials.

- Get the access ID of 9 digits and submit the application.

Pradhan Mantri Vaya Vandana Yojana Interest Rate

| Mode of Pension | Effective Interest Rate per annum |

|---|---|

| Yearly | 7.60% |

| Half-Yearly | 7.52% |

| Quarterly | 7.45% |

| Monthly | 7.40% |

PMVVY LIC Scheme PDF

| PMVVY LIC Sales Brochure – Hindi | PMVVY LIC Sales Brochure – English |

| Policy Document | Policy Sales Brochure (Basic Guidelines) |

You May Like